Case Study

Jan 16, 2026

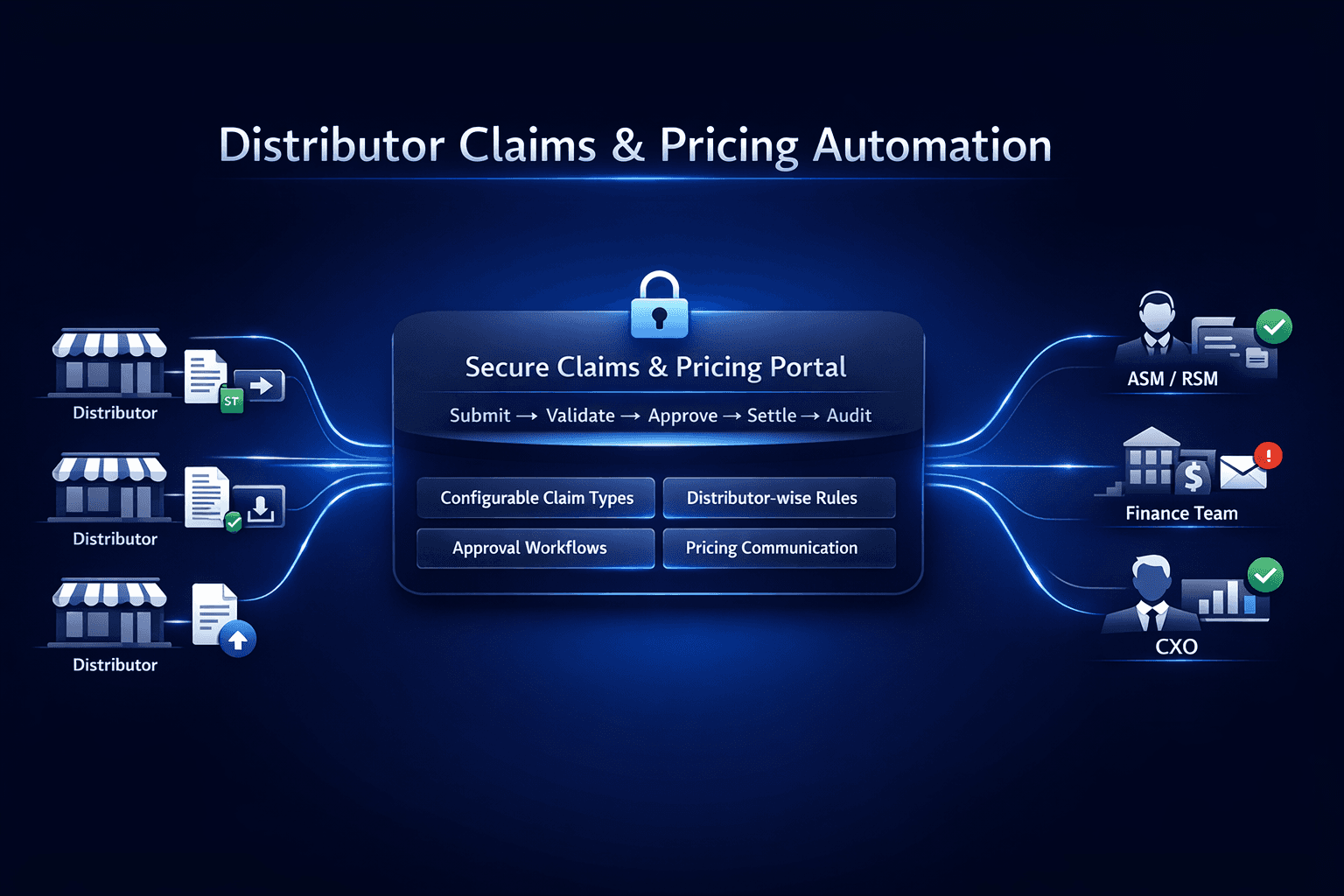

Industry: FMCG / Ice Cream (Franchisee Model) Scale: 80+ distributors Claims cycle reduced from 3 months to ~1 week with a secure portal, configurable settlement logic, and audit-ready workflows.

The Business Challenge

Distributor relationships strained due to delayed claim settlements impacting working capital

Revenue leakage from duplicate, incorrect, and disputed claims

High sales & leadership bandwidth spent on audits and escalations due to lack of a reliable system of record

The Operational Challenge

Claims and pricing communication ran on emails and spreadsheets - from submission to settlement

Frequent miscommunication and manual errors in pricing, settlements, and scheme reconciliations

Manual verification of documents and calculations delayed settlement cycles

Teams spent significant time chasing updates due to low visibility and frequent follow-ups

What We Built

A secure claims and pricing portal enabling structured, auditable communication between distributors and business stakeholders - without disrupting existing workflows.

Configuration & Calculation Flexibility

Fully configurable claim types at the distributor level (promotions/schemes, shortages, rate differences, damages, samples, logistics, etc.)

Flexible settlement logic and reconciliation templates - designed to adapt to distributor-specific margin structures and changing pricing

Centralized controls to maintain consistency without slowing down change

Built-in automated data quality checks to prevent bad data from entering the system (including checks for FIFO sales / duplicate claims etc.)

Flexible, user-defined rules to ensure distributors submit only valid and approved codes (e.g., distributor code, channel code, SKU code)

Masters, Workflows & Communication

Secure distributor-level access - each distributor sees only their own data

Centrally managed masters (SKU, pricing, discounts) to ensure consistent communication and accurate calculations

Role-based accountability and approvals across Distributor → ASM/RSM → Finance, enabling validation and settlement sign-off

Automated email triggers across the entire claims lifecycle, including data ingestion notifications, approval/rejection communications, claims cover note availability, and collaboration emails

Our Implementation Strategy

The customer had attempted to solve this earlier using Zoho Analytics, but adoption and execution stalled due to:

Distributor-specific reconciliation logic creating excessive development and change backlog

A rigid interface that wasn’t usable for non-technical distributor teams – leading to low adoption and stalled rollout

Limited data processing capabilities that did not work with higher volumes and complex business specific derivations

Using Wekalp’s process discovery and flexible templates, we operationalized distributor-wise settlement logic and delivered the initiative within 3 months.

Impact

Claims cycle reduced from ~3 months to ~1 week

Real-time 360° visibility of claim status for distributors and leadership

Revenue leakage prevented through structured validations and audit-ready workflows

Seamless audits and reduced escalations through a single system of record

A scalable foundation for finance automation and data lake initiatives

What’s Next

Q-commerce reimbursement and reconciliations

Finance close automation

Customer Loyalty Analytics

Key Takeaway

Claims automation only works when the platform adapts to real-world complexity. In this rollout, distributor-specific rules and approvals were the core challenge - and flexible configuration is what enabled speed, adoption, and audit-ready execution